On August 16, changes to the 2021-2025 collective agreements negotiated by employers and unions were ratified by the Construction Industry Social Benefits Committee. These changes concern the MÉDIC Construction insurance plan.

New employee contribution and increase in the employer contribution to the basic insurance plan

For hours worked starting August 29, the following modifications will apply:

- Withholding from workers’ pay of a new employee contribution of $0.23 for the basic insurance plan, plus the applicable 9% provincial tax

- Increase of $0.40 in the employer contribution to the basic insurance plan for a total of $2.50, plus the applicable 9% provincial tax

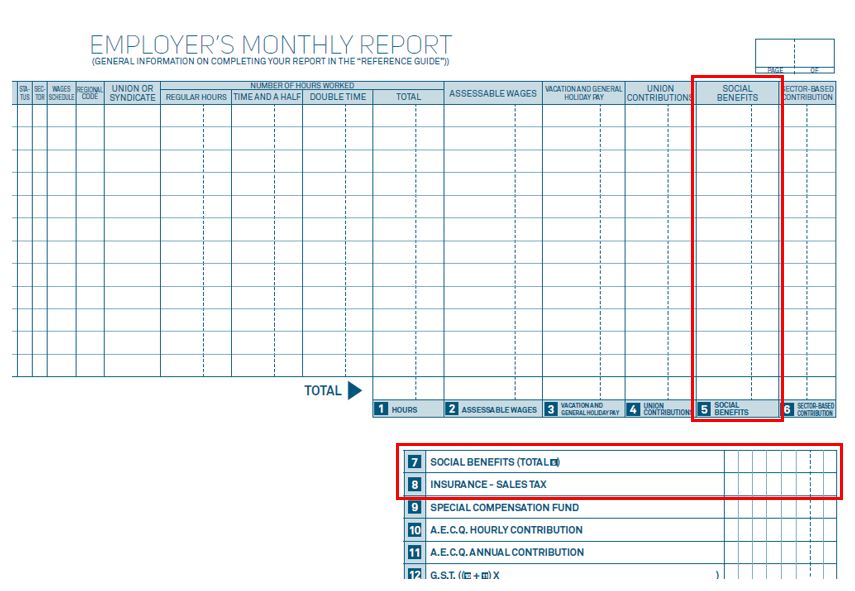

These new amounts must be included in the September monthly report, due by October 15 at the latest. The “Avantages sociaux” (social benefits) amounts (column 5 and line 7) and the “Taxe de vente – assurance” (sales tax – insurance) amounts (line 8) must contain the employer and employee shares (see below). This means that the new contribution of $0.23 will have to be added into the “Avantages sociaux” element, and the applicable tax on this amount into the “Taxe de vente – assurance” element.

If you are an employer and your company does business with an accounting software firm, you should know that the firm has been contacted to inform it of these changes and how to integrate them into its software.

Supplementary insurance plans for painters and boiler makers in the ICI sectors

Please note also that as of August 29, a new supplementary insurance plan for boiler makers will be created in the institutional and commercial and industrial (ICI) sectors. In addition, the supplementary insurance plan for painters will be extended to these sectors. These employer contribution rates to the supplementary insurance plans therefore must be considered in the September monthly report. A reserve must be formed before employees are covered by these plans.

Please note that all rates given above will be updated on Tuesday, August 24, in the CCQ’s online services and in the wage rates tool available in the Wages & Rates section of our website.

For more information about the changes under the new collective agreements, please contact your association directly.

If you are an employer and want more information concerning the production of your monthly reports, please contact our Customer Service.